- Bcg Matrix Of Microsoft Company

- Bcg Matrix Of Microsoft Company Information

- Bcg Matrix Of Microsoft

- Bcg Matrix Of Microsoft Company Information

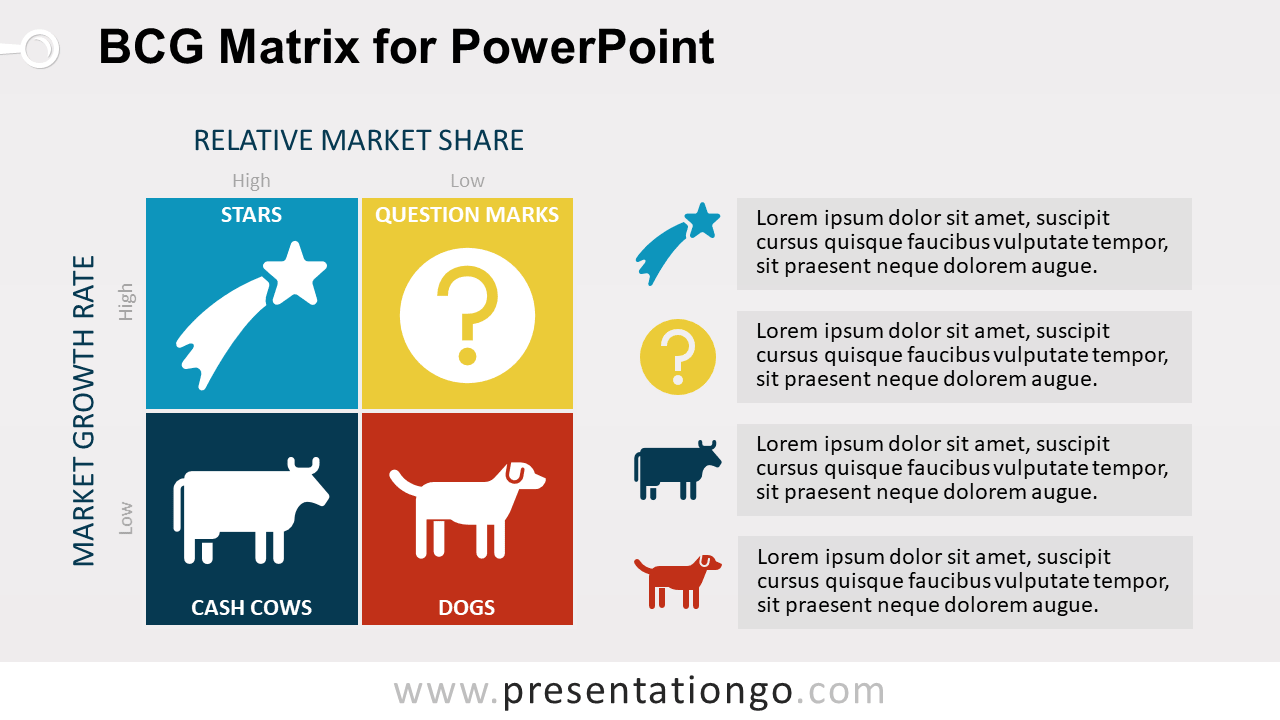

The BCG Matrix for Microsoft will help Microsoft in implementing the business level strategies for its business units. The analysis will first identify where the strategic business units of Microsoft fall within the BCG Matrix for Microsoft. A perfect example to demonstrate BCG matrix could be the BCG matrix of Pepsico. The company has perfected its product mix over the years according to what’s working and what’s not. Here are the four quadrants of Pepsico’s growth-share matrix: Cash Cows – With a market share of 58.8% in the US, Frito Lay is the biggest cash cow for Pepsico. Devised as a portfolio planning tool, or corporate planning tool, the BCG growth-share matrix was first conceived by Bruce Henderson of the Boston Consulting Group back in the 1970's. The concept is based on four quadrants in which a company's strategic business units (SBU) or products/brands are classified.

As per McKinsey, GE-McKinsey is a strategy-based tool that contains a nine-box matrix and provides a systematic way to the multi-business corporation for the purpose of prioritizing its investments among its subunits (business units).

In simple terms, GE-McKinsey Matrix is considered as a framework to evaluate the portfolio of businesses, gain insights into strategic implications, and set a priority of the investment required for each BU (business unit).

This matrix is also known as McKinsey Nine Box Matrix which is used by multi-business firms for the planning of their business portfolio. A group of businesses that jointly form a company is considered as a business portfolio. These independent businesses are generally termed as strategic business units (SBUs).

OVERVIEW

Today’s business world is more focusing on its decisions related to investments due to the increasing scarcity of resources. In this scenario of limited availability of resources, Businesses are required to make decisions based upon the best utilization of their cash and investments aiming at maximum ROI (Return on investment). The quarrel for investments can be viewed in every stage of a firm such as among teams, departments, business units, or divisions. In the case of diversified businesses, more complexity arises in this resource allocation quarrel as various brands, products, and portfolios are supposed to be managed. So, it becomes a headache for people or management to decide upon how much and where to invest cash for its proper utilization.

Companies that are into diversified businesses, manage complicated business portfolios, mostly, consist of a huge range of products and services. These diversified products or business units are different from each other in terms of their functioning, future prospects, and performance. So, it becomes very difficult for companies to decide upon into which products they should invest. Here the role GE-McKinsey Matrix comes as it supports businesses in this decision-making process in a more informed and systematic way. It is a strategic tool that solves the investment problem by making a comparison of business units and further assigning these units into the relevant groups that are either worth investing or should be divested or harvested.

ORIGIN OF GE-MCKINSEY MATRIX

BCG Matrix Template Excel Features Now generate even more revenue from your company products through getting this template. It helps in managing both smaller and larger companies. Although BCG matrix, is actually requirement of bigger companies, still smaller and medium size companies are also able to use it efficiently. The growth share matrix was created in 1968 by BCG’s founder, Bruce Henderson. It was published in one of BCG’s short, provocative essays, called Perspectives. At the height of its success, the growth share matrix was used by about half of all Fortune 500 companies; today, it is still central in business school teachings on strategy.

The GE-McKinsey Matrix was developed in the 1970s when McKinsey & Company was hired by GE (General Electric) company to develop a tool or model for analysis and management of a business portfolio that is best suitable as per their requirements.

In the 1970s, projections related to future cash flows, market growth, etc. were the main elements for the companies to make decisions of investments. This was not a reliable way to assign resources to different products. GE was handling a complex and large portfolio of products that were not related to each other. But, GE was not satisfied with the returns from investments in its portfolio of products. At that time, GE was operating around 150 business units and was using BCG (Boston Consultancy Group) Matrix but over the period more sophisticated tool was required to help the company in deciding for the units that actually deserved investments of funds for development. So, with the help of McKinsey & Company, a nine-box tool i.e. GE-McKinsey Matrix was designed which is a strategy tool aimed at supporting business in making decisions related to whether invest or not in its sub-business units or products.

The business units are plotted on 9 cells of the above none-box GE-McKinsey Matrix that shows if the company is safe to invest in a product. Also, harvest or divest the product if it is unsafe to invest or whether further research is required on product investment i.e. either hold for time being or adopt a strategy of selective investment. The evaluation of business units is conducted on 2 axes i.e. competitive strength of the business unit and industry attractiveness.

The above nine-box matrix is considered as a systematic method for the decentralized and multi-business corporation to decide the best product or business for investing money.

Instead of depending upon the projections of each business unit’s future prospects, the corporate can evaluate whether a business unit will provide better returns in the near future by using the above two factors of the GE-McKinsey Matrix tool. By placing business units within the 9-box matrix, a logical and analytical map for their proper management is available. Business units that are placed above the diagonal in the above GE-McKinsey diagram may be pursued for further investments and growth by a business. Whereas business units along with the diagonal may be considered for selective investment strategy, and other business units that are placed below the diagonal should be a harvest or divest. It is essential to place business units into these 3 categories of the matrix at the starting of the analysis for further judgment.

AXIS OF GE-MCKINSEY MATRIX

The y-axis of the matrix represents market attractiveness and the x-axis shows a business unit’s competitive strength. Let’s have a look at both strategies below:

Industry attractiveness

It shows whether it will be tough or easy for a business to face competition in the market and gain profits. Industry becomes more attractive if it is more profitable. Different factors are included in industry attractiveness to determine the level of competition in it in a collective form. Following are the most common factors for industry attractiveness:

- The Growth rate in the long run

- Size of industry

- The Profitability of industry: This includes both entry and exit barriers, power of supplier and buyer, the threat of available complements and substitutes

- Structure of industry

- Changes in the Product life cycle

- Demand changes

- Price trend

- Macro environment factors

- Labor availability

- Market segmentation

- Seasonality

The Competitive strength of a BU (Business unit) or a product

Apart from industry attractiveness, the matrix also measures a business unit’s strength against its main competitors. Business strength is analyzed by business managers to determine if a sustainable competitive advantage is present in a business unit or not. In case of the presence of the same, the next issue arises is related to the period for which it will be sustained. The below factors decide a business unit’s competitive strength:

- Total share exists in the market

- Growth of market share as compared to competitors

- Strength of the brand or brand value

- Company’s profitability

- Customer loyalty

- VROP capabilities or resources

- Strength of a business unit to meet critical success factors of the industry

- Strength of a supply chain

- Product differentiation level

- Flexibility of production

INVESTMENT STRATEGIES FOR THE MATRIX

After placing SBUs in the matrix, companies can make investment strategies according to the position of SBU within the matrix. There are three alternates of investment strategies i.e.:

Grow

This category includes those business units in which corporate prefer to invest because of their strong position to generate high returns in the long-run. These investments can be into acquisitions, Research & Development (R&D) activities, brand expansion, advertisements, and production capacity enhancement.

Selectivity

The position of business units fall under this category is ambiguous and their future growth is unclear. Or in other words, it is difficult to predict if these business units will perform in the future remain stagnant. This category is liable for investments only in case of strategic aim of these and once the amount is already invested into the business units under the Grow category.

Though the potential of these business units is not clear, it doesn’t mean that the money won’t be invested in these. However, investments won’t be made in these BUs until the confirmation is there that investment in the SBUs under the Grow category is done.

Harvest or Divest

This category of investment strategy includes poor performing business units that are in less attractive markets and industries. If these business units contribute to revenue generation equivalent to the investment; then only investment will be made into these. In the absence of this, the possibility may arise to liquidate these.

Detailed elaboration of GE-McKinsey Matrix:

GE-MCKINSEY MATRIX (DETAILED VERSION)

The detail of each option in the above matrix is as under:

- Protect position: This includes investment for protecting the position in the market and rapid growth.

- Build selectively: Consists of obtaining specialization in limited strengths in order to increase the ability to face competition. In case there is no possibility of competitive advantage or sustainable growth, then adopt the strategy of withdrawal from the market.

- Invest to build: Includes investment for the purpose of strengthening position in the market by developing strengths. Areas of vulnerability need to be managed.

- Manage for income: To invest in those areas of SBUs in which the earning or income potential is good and risks are comparatively low. Profits need to be maintained by upgrading the products that are most profitable.

- Harvest or Expand: If it is possible to expand with low investments then only look for it, else, operations to be streamlined to harvest the investment.

- Divest: This demands cost-cutting and no investment with immediate effect. For releasing the cash value for the company, the business unit should be sold.

- Protect position and refocus: To shift the currently available strengths of the business into a new market, it is required to view the possibilities of refocusing the business.

The process of GE-McKinsey Matrix

1. Determine each business unit’s industry attractiveness

This includes the following steps:

- List down factors: This is the first step in which a list of relevant factors needs to be identified and compiled while measuring the attractiveness of the industry. Some common factors are available across industries but an organization should choose the most appropriate factors for its business. These factors may include growth rate, size, environmental factors, competitive landscape, profit margin, etc. that affect the industry.

- Allocate weights: It is mandatory to give weights to the factors that have been listed. These weights indicate the value of the factor in determining industry attractiveness. This weight could be anything between 0.01 (not important) and 1.0 (extremely important) which has to assign to each factor. The aggregate of all the weights should be 1.0.

- Provide rating to the factors: Once the weight is allocated to the factors, the next step is to rate each one of them associated with each business unit or product of the company. Values can be selected between 1 to 5 or between 1 to 10. In this, 1 shows the low attractiveness of the industry, wherein, the scoring of 5 or 10 represents the high industry attractiveness.

- Determine the weighted and total/final scores: Once the weights and ratings are ready, a final or total score is calculated which is the aggregate of the weighted score of all factors for each business unit. Weighted scores are determined by multiplying ratings and weights.

By using the total score, companies can compare the industry attractiveness of each SBU.

2. Determine each business unit’s competitive strength

This includes the evaluation of the competitive strength of each business unit of the company. The process is the same as in the case of industry attractiveness except the evaluation is based on competitive strength this time. The process is mentioned below in brief:

- Factors list: Choosing and preparing a list of the available factors of competitive strength.

- Weight allocation: This represents the importance and role of each factor to achieve sustainable competitive advantage. Each factor should be assigned weight from 0.01 (not important) to 1.0 (most important). The total weight should come in equals to 1.0.

- Factor rating: The rating of each factor in each business unit should be between 1 to 5 or it can be between 1-10. Rating 1 symbolizes weak strength and rating 5 or 10 shows superior strength.

- Total score calculation: This is to obtain the total weighted score.

3. Positioning each business unit on Matrix

Now, after getting a score on industry attractiveness and competitive strength for each business unit, the next step is to position them on the matrix. A circle should represent each business unit that indicates the market size of each business unit as compared to other business units.

4. Information analysis

This includes analyzing the strategic possibilities for business units. The three investment strategies that an organization can adopt for each business unit are depending upon the position that each business unit occupies in the matrix. As discussed above, these strategies include grow or invest, income or selectivity, and harvest or divest. Each business unit is placed within these categories that determine what action to be executed in terms of investment. These investment strategies or investment implications are explained below in detail:

- Grow or invest areas in the matrix: It is suggested that companies should look for investments into those business units that fall into this category of matrix boxes as they offer a higher rate of return in the long-run. A lot of cash will be required by these as they will function in growing industries. Also, it will be essential for them to grow or maintain their market share. This investment is required for multi-purposes such as R&D activities, acquisitions, advertisements, etc. to meet future demand.

- Income or Selectivity areas: Companies should seek to invest in business units that fall under the income or selectivity box in the matrix only if they have enough remaining money after investing in grow or invest business units; and if there are possibilities to generate money from these business units in future. These BU’s are mostly considered at the end due to a great amount of uncertainty they carry.

- Harvest or Divest areas: There are business units that operate in unattractive markets or industries and there is no sustainable competitive advantage from them. Also, these business units are not even capable of achieving it and these perform comparatively in the poor form under harvest/ divest areas within the matrix. In this case, the question arises of what strategy to adopt for such BUs?

The solutions to the above question can be:

a) In case of excess cash generated by business units, companies should take them like business units that come under the area of cash cows in the BCG matrix. In other words, invest enough into these business units to keep them working and until they are generating cash incomes. So, it is profitable to make investments in such business units as long as an investment doesn’t go beyond the cash generated from them.

b) It is advisable to divest those business units that are running under losses. If it’s not possible to convert losses into profits then the company should go ahead with the liquidation of these business units.

5. Projection of the future potential or direction of business units

Through the above analysis of GE-McKinsey Matrix, a company can see the current scenario of each business unit’s industry attractiveness and competitive strength but it doesn’t predict their future scope of change. So, further analysis of each business unit’s potential is required as it may clarify that if investments are made in a few business units then it is possible to improve their competitive positions. Also, major growth in that industry may be experienced in the future later. This creates an impact on the decisions of investments that a company makes into its business units.

For instance, in the above evaluation, it shows that Business Unit 2 falls under the invest/grow category, but after undergoing further analysis, it reveals that this business unit has a tendency to shrink in the near future. So, in the upcoming future, the investment strategy of this business unit will be either harvest or divest instead of invest or grow. So, a company won’t invest the same amount in business unit 2 as it was investing in it during the initial phase. To represent the future direction of each business unit, an arrow may be used.

Below is the expectation w.r.t each business unit according to future analysis:

SBU1: The company expects that the industry attractiveness and competitive strength of this business unit will improve in the near future.

SBU2: The company expects that competitive position will decline with time and industry will become less attractive.

SBU3: It’s expected that industry attractiveness will remain the same as it is now, but the competitive strength of this business unit is expected to improve.

FUTURE DIRECTION OF BUs IN MATRIX

6. Prioritize investments

This is the last step in the process that includes making decisions about where and how the investment of the cash to be made. Few queries that may require solutions along with matrix analysis are:

- Is it really fruitful to invest in some business units?

- How much to invest in different units?

- Which sectors like R&D, customer service, marketing, value chain, etc. require more investment within a business unit for improving its performance?

EXAMPLES OF GE-MCKINSEY MATRIX (PRACTICAL IMPLICATIONS IN RENOWNED BRANDS)

1. Apple Inc.

Let’s see the practical implication of GE-McKinsey Matrix with an example of a large technology brand Apple Inc. The company hastha multi-businesses or multi-business units that are operating in different markets such as laptops, desktops, Tablets (iPads), smartphones (iPhones), portable music players (iPods), etc. Apple also develops software to facilitate these products.

A competitor of Apple who is looking to gain competitive access to Apple’s activities could do this by plotting its business units in the matrix. Through this analysis, the competitor could find out different business units into which apple is about to invest a huge amount, divest, or develop selectively. The x-axis i.e. industry attractiveness would be comparatively easy to access for the competitor in case of operating in the same market, as this includes Apple’s external factors. This consists of information that could be easily revealed like the growth rate of the market, the current size of the market, etc. Still, few factors would have to be examined thoroughly, like entry barriers and technological development.

On the other hand, the competitive strength of the business unit i.e. y-axis would be quite tough to be assessed as it includes internal factors of Apple i.e. access to resources, the strength of management, customer loyalty. In this, secondary sources like media, internet, etc. could be a great help to obtain a great amount of information.

2. Invest or Grow strategy of Ford electric car

Ford was not investing in the electric car couple of years back even being the most famous automakers around the world. Two major reasons were there of doing so i.e.:

- Ford has a strong presence or core competency in the sector of a classic automobile, but in the electric automobile, it is not there. To design and manufacture an electric automobile like an electric car is quite different from the traditional automobile in terms of powertrain, engine, etc. The components are totally different from an electric car in which Ford had no strong expertise.

- Another reason was the market as the demand for electric cars was rising but people preferred traditional cars. Thus, it was not actually a booming market of electric cars that time as the industry was not that attractive for the electric car segment.

To find a solution, Ford did research and once they made their base strong in the segment of electric cars and also, the industry became much attractive; then Ford made an investment in it.

Bcg Matrix Of Microsoft Company

3. Divest or Harvest strategy by Microsoft in Zune mp3 player

In 2006, Microsoft has introduced its mp3 player i.e. Zune. A year later, once Apple launched iPhone then Mp3 players started escaping from the market. The smartphone market which was emerging and new industry resulted in making mp3 players totally unimportant. People started using their phones.

To get rid of this, Microsoft discontinued its mp3 player brand Zune in 2008. It was the right decision for the company as they hadn’t any strong presence in the market or industry of mp3 players and it couldn’t get success in this. Also, the mp3-player industry had lost its attractiveness after the launch of the smartphone by Apple

MERITS OF GE-MCKINSEY MATRIX

1. Businesses that have business units more than a hundred can raise complexity. Also, businesses are lack of infinite resources for investment. The GE-McKinsey Matrix facilitates businesses to make an analysis of the portfolio of their business units to discover:

- Business units that should get less or more investment.

- New products that should be added to the portfolio of business.

- Products or business units that need to be divested.

2. It helps in raising awareness for the performance of business units or products in the respective industry or market. Also, it assists in strategy development to gain maximum returns from available resources.

3. Facilitates in extracting information related to the strengths and weaknesses of a business unit and to use strategies for improving the performance of business units.

4. Helps businesses in their growth and acts as an information resource for market opportunities in the future.

LIMITATIONS OF GE-MCKINSEY MATRIX

Different challenges or limitations are also there with the matrix such as:

- It is very difficult to determine the attractiveness of the market especially in a market that is operating in an ever-changing environment.

- Also, discovering the business unit’s strength and assigning weight to it against industry attractiveness is also quite tough. So, in the case of a mismatch of variables, a company might invest in the growth of a business, which is otherwise required to be held back and it ultimately leads to unnecessary wastage of resources.

How should your company progress? If you are looking for the right strategy for your products or services, the BCG matrix can help. This portfolio matrix helps with analyzing business units e.g. manufactured products. What are the chances of this product being successful? And above all: is your portfolio set up well enough to achieve long-term success for your company? The BCG matrix tells you what you need to know.

The system was developed for the Boston Consulting Group, which is why the matrix is also known as the “BCG portfolio” or simply the “Boston matrix.” The founder of the group, Bruce Henderson, had already invented the system with four sectors in 1970. His goal was to provide companies with a simple tool with which they could plan their long-term strategy: Which product lines should be invested in and which shouldn’t?

- What is the BCG matrix?

What is the BCG matrix?

Similar to the Ansoff matrix, the portfolio matrix consists of four areas, which in turn result from the combination of four different factors. The matrix itself is in a coordinate system: the x-axis indicates the relative market share and the y-axis the market growth. Both scales range from “low” to “high.” A new zone starts on half the scale. The products in the company’s own portfolio can be placed in these zones depending on the two axes.

- Market share: the relative market share results from the company’s own market share compared to that of its strongest competitor. If the value is greater than 1, you are the market leader, otherwise you’re the market follower.

- Market growth: Describes the growth of the market for a particular product unit i.e. the current market volume in comparison to that of the previous period; it is stated as a percentage.

The Boston matrix is also called “Growth share matrix” because of its axis designation.

A third dimension results from the sales of the corresponding product. This is expressed by the size of the circle representing the respective business unit.

Depending on which zone the product is located in, different strategies can be established for your further planning.

Bcg Matrix Of Microsoft Company Information

Question marks

Products in the “question mark” category are characterized by high market growth combined with a low market share. These are generally new products and services that still have a small market share compared to that of the competition, but are in a rapidly growing market. These products are called question marks because it’s impossible to estimate any future development. In order for the products to be successful in the long term – i.e. to move into the “stars” category – entrepreneurs have to invest a great deal.

Bcg Matrix Of Microsoft

The problem is that it requires a lot of investment to make a question mark product more successful because the item can’t support itself. The strategy is therefore very clear: selection. A company cannot afford to fund every business unit in this area and must choose exactly which product it wants to invest money in.

Stars

Stars have both a high market share and high market growth. As market leaders, these “stars” have a high return on investment (ROI). Therefore, it’s not a problem to continue investing in these products and therefore ensure long-term success. If stars maintain their high market share over a longer time, they can become cash cows.

Cash cows

Bcg Matrix Of Microsoft Company Information

Products or services known as “(dairy) cows“ also have a relatively high market share, but are in a market that is growing very slowly or not at all. They generate a very high and steady cash flow even without any investments. On the contrary: Products found in the cash cow area of the portfolio matrix generate the financial means that are invested in question marks or stars.

Poor dogs

“Poor dogs” are products or services that a company is phasing out. Market growth is low, stable, or even declining. The relative market share is also low: compared to the market leaders, hardly any sales are generated with these products. As a result, products like these are barely self-sustaining. Companies must pursue a divestment strategy when the product can sustain itself no longer. The capital contained in these products is extracted again in order to have more liquid funds.

Thanks to its wide range of programs, Microsoft 365 is guaranteed to lighten your workload. Get the package that best suits your needs now from IONOS!

The BCG matrix explained using an example

We’ll use a fictional company: Bob’s Butchers. With the help of the Boston Consulting Group matrix, the managing director of the company wants to review the portfolio and develop sustainable strategies. The company currently has six products on the market: beef goulash, pheasant, chicken, pepperoni, chorizo, and a vegetarian sausage. Bob’s Butchers has two competitors: Brenda’s Butchers and Barry’s Butchers. The BCG matrix first of all needs an analysis of the market and the competition in order to calculate the market growth and relative market share figures. The managing director receives the following (fictitious) values:

Market growth

To determine market growth, the managing director looks at the entire market and compares the two previous years with each other.

2016 (in millions. $) | 2017 (in millions. $) | Market growth | |

Beef goulash | 12 | 13.8 | 15 % |

Pheasant | 15 | 15.75 | 5 % |

Chicken | 2 | 2.04 | 2 % |

Pepperoni | 7.3 | 7.8 | 7 % |

Chorizo | 2 | 2.36 | 18 % |

Vegetarian sausage | 5.2 | 6 | 15 % |

Relative market share

For the relative market share, the market shares of your own company and those of all competitors must be taken into account. The value results from how your own company relates to the market share of the most successful competitor in the respective business unit.

Bob’s Butchers | Brenda’s Butchers | Barry’s Butchers | Rel. market share | |

Beef goulash | 55 % | 40 % | 5 % | 1,37 |

Pheasant | 27 % | 54 % | 19 % | 0,5 |

Chicken | 16 % | 36 % | 48 % | 0,33 |

Pepperoni | 60 % | 32 % | 8 % | 1,87 |

Chorizo | 20 % | 52 % | 28 % | 0,38 |

Vegetarian sausage | 34 % | 18 % | 48 % | 0,7 |

Now Bob’s Butchers’ managing director can enter their products in the BCG matrix from the calculated data. In doing so, it also takes into account the sales generated by each business unit and incorporates this information into the size of the circles.

Now Bob’s Butchers’ managing director can see how to plan investments in their products. The pepperonis have turned out to be cash cows; they generate enough cash flow to finance the beef goulash so this is a star that the managing director should definitely invest in. However, the question is how should the manager deal with the two questions mark products: chorizo and vegetarian sausage? However,

It may be advisable to make a selection: The managing director could, for example, decide to only promote vegetarian sausages if they think this could be the most promising. If the vegetarian sausage develops into a star, Bob’s Butchers must not forget to create a new question mark to be successful in the long run. The company also has two poor dogs: pheasant and chicken. While the pheasant still generates quite high sales, the chicken is very poorly positioned. This tells the managing director one thing: disinvestment.

The BCG matrix enables a company to sustainably plan the future of business units and investments.